Mitsubishi UFJ Financial Group, Inc.

Creating a new customer experience for

the next generation through digital transformation.

Challenges

- Digitization of financial services for creating a more convenient society

- Shrinking workforce in Japan requires greater use of automation

Solution

- Use digital technologies to increase productivity and customer satisfaction

- Partner with NTT Communications to deliver diverse digital technologies globally

Benefits

- Improves productivity by using AI and voice analysis technology

- Meets rising customer demand for video technology and AI

Mitsubishi UFJ Financial Group, Inc.

General Manager, Digital Transformation Division

Hirofumi Aihara

"NTT Communications provides total business

support beginning at the conceptual stage and is

an indispensable partner to realize future-oriented

financial services."

Challenges

Transform business through digital technology to boost customer loyalty and improve productivity

The Mitsubishi UFJ Financial Group (MUFG) offers diverse financial products and services, contributing to the positive development of society and enabling customers to have more fulfilling lifestyles. The group announced the MUFG Re-Imagining Strategy with the goal of being recognized and chosen for financial services throughout the globe. This strategy aims to achieve sustainable growth for the group and to contribute to the betterment of society.

"Business transformation through the use of digital technology" is one of the four pillars of the new business strategy. For MUFG, this means leveraging its strengths as a provider of comprehensive financial services to meet customer needs, anytime and anywhere, and improving individual consumer loyalty by delivering new and better customer experiences.

Hirofumi Aihara of MUFG explains, "Financial services have been focused mainly on face-to-face customer service at branches, but digital transformation of society is accelerating with the spread of the internet and smartphones. We believe it is crucial for financial services to move in the direction society is moving."

In Japan, society is moving toward a shrinking workforce and corporations anticipate difficulties in securing sufficient human resources in the future. Digital technology will be indispensable in achieving labor savings through increased automation and it will help in the effective deployment of available human resources.

MUFG is already making progress in this direction through the use of AI at bank IT help desks. An Al chatbot is able to offer appropriate responses to customer questions. This is expected to boost help desk efficiency. MUFG is also testing application of the latest voice recognition technology to support the preparation of minutes for meetings.

Solution

Evaluate comprehensive strengths with diverse digital technologies

Embrace a collaborative business strategy

MUFG is improving worker efficiency, starting with verification of its own technologies. The group also plans to apply the knowledge and expertise it gains through this process to customer-facing services.

According to Mr. Aihara, "We are aiming for ‘future-oriented communication' that realizes high-quality customer service through digital technology." To this end, the group is promoting the use of digital technology more than ever as it strives to improve operations and services. To supplement in-house resources, MUFG selected NTT Communications (NTT Com) as its partner for ongoing digital initiatives.

Mr. Aihara describes the reasons for this selection: "NTT Com is pursuing research and development of state-of-the-art technologies on a long-term basis and offers many infrastructure solutions such as data centers, networks and the cloud, as well as digital technologies like AI. NTT Com is able to flexibly integrate systems that utilize these technologies. We highly evaluate their comprehensive ability to deliver various layers of technology globally and provide solutions all in one package."

Technological benefits aside, Mr. Aihara also agrees with NTT Com's stance of collaboratively examining business strategy. "From early conceptual stages, NTT Com puts itself in our position and thinks about business goals and strategies together. They focus not only on technologies, but also on the resolution of issues and realization of goals, and then propose appropriate technologies and solutions. I have a strong impression of them as a reliable partner."

Benefits

Meeting customer demand for high-quality services using the latest video and AI technology

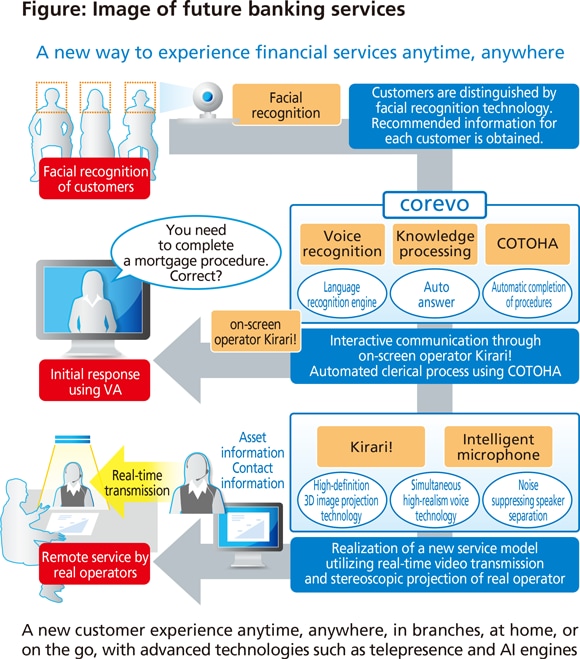

MUFG is moving forward with various initiatives supported by NTT Com to realize the communication services of the future. Among them is customer service using advanced Kirari for Mobile technology and the COTOHA* AI engine. Kirari! For Mobile is an immersive telepresence technology that uses stereoscopic image projection to display images so realistic that a remote person or virtual assistant (VA) appears to be right in front of you. The COTOHA AI engine understands written and natural spoken language and is capable of advanced communication with humans. When serving as the brain of the VA, COTOHA can provide services with human-like warmth.

Mr. Aihara says, "With these advanced technologies, we believe it is possible to provide financial services anytime, anywhere in the form of a realistic experience in branches, at home or on the go. COTOHA-supported VAs, for example, can provide appropriate service based on customer information. When customers need expertise in areas such as asset management or mortgages, remote experienced staff can "visit" them anywhere in the world through telepresence technology to provide attentive, detail-oriented service." The first trial of VA using Kirari! took place in September 2017 at the Singapore branch of The MUFG Bank, Ltd..

MUFG is also testing speech recognition technology that converts recognized speech to text with a high degree of accuracy. Data accumulated while serving customers at branches and call centers is also stored and used for Big Data analysis to extract new findings for applications in products and services that create new value. "With NTT Com, we are first verifying technology that prepares the minutes at internal meetings. Knowledge gained from this verification should support the development of our next-generation communication services."

Meanwhile, MUFG is also working to upgrade its business base using the Enterprise Cloud 2.0 platform. According to Mr. Aihara, "We have already used it as an application development environment in Singapore. Within this fiscal year, we plan to utilize it as block chain infrastructure that supports secure and efficient financial transactions."

With the support of NTT Com, MUFG is accelerating its business evolution through digital transformation to realize the benefits of future communications that can deliver top-quality customer service.

*COTOHA features NTT Group's Corevo AI technology, which incorporates advanced Japanese-language processing technology from the NTT Media Intelligence Laboratory.

Company Profile

Name: Mitsubishi UFJ Financial Group, Inc.

Revenue: JPY 4,011.8 billion (as of March, 2017)

Business: A bank holding and comprehensive financial services group with core companies including The MUFG Bank, Ltd., Mitsubishi UFJ Trust and Banking Corporation, Mitsubishi UFJ Securities Holdings Co., Ltd., and Mitsubishi UFJ NICOS Co., Ltd. Develops and promotes cross-sectional strategies that focus on retail, corporate, international, trust property and marketing businesses.

URL: https://www.mufg.jp/english/![]()

In order to read PDF documents, you need Adobe Reader.

In order to read PDF documents, you need Adobe Reader.

(as of September 2017)

Related link

EN

EN

'Mitsubishi UFJ Financial Group, Inc..' case study

'Mitsubishi UFJ Financial Group, Inc..' case study